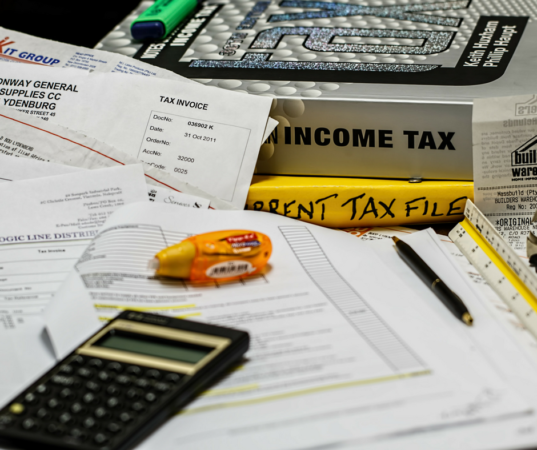

Excess cash management tips

Tips and hints on excess cash management in your small business

Tips and hints on excess cash management in your small business

By Yeo & Yeo CPAs & Business Consultants Warm weather and rainy days bring the urge to purge. But before you clean your file cabinets or declutter your computer files, […]

Recent changes to federal tax law and accounting rules could affect whether you decide to lease or buy equipment or other fixed assets.

When a sale of a business or investment property results in a gain, the seller is typically taxed on that gain during the year of the sale, even when the gain was generated over many …

Article by Gordon Advisors, P.C. There are probably several dozen questions you could ask a small business accountant vying to work for your company. But would you also take the […]

The ways in which a CPA can be a trusted advisor for your small business

Many businesses will pay less federal income taxes in 2018 and beyond, thanks to the Tax Cuts and Jobs Act (TCJA). And some will spend their tax savings on merging with or acquiring another business.

Business taxpayers should be extra alert for cybercriminals attempting to steal W-2 forms and other sensitive information through a phishing scam.

The holiday season is a great time for businesses to show their appreciation for employees and customers by giving them gifts or hosting holiday parties.

Yeo & Yeo's Year-end Tax Planning Checklist provides action items that may help you save tax dollars if you act before year-end.

Business mistakes can take on various forms, but one of the most significant is in the financial arena.

If you decide to open a business, the process involves creating a plan for success.

Every small business owner knows being an entrepreneur is a lot of work and takes a lot of attention to detail to do well.