The IRS has announced increased annual limits for retirement and other benefit plans for 2024. While the increases for 2024 are smaller than we’ve seen in prior years, they still may have a significant impact on plans and participants. For participants, increases in the limits on elective deferrals and HSA contributions mean that they will be able to save more for retirement and medical expenses on a tax-free basis. Additionally, because of the annual compensation limit increase, plans may have to take into account more of their employees’ salaries when calculating employer contributions such as an annual match. If you have questions about how these limits could impact your organization, plans or employees, please contact your Warner attorney or a member of our Employee Benefits Practice Group.

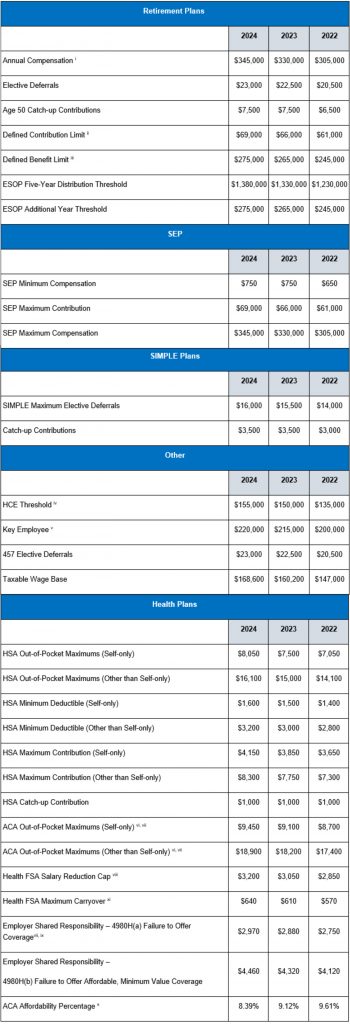

The following chart lists the common limitations. These limits are calendar year limits, except as otherwise noted.

i. The plan defines whether compensation is measured on a Plan Year or Calendar Year basis. The 2024 limit applies for the year beginning in 2024.

ii. The 2024 defined contribution limit applies to the Limitation Year, as defined by the plan, ending in 2024.

iii. The 2024 defined benefit limit applies to the Limitation Year, as defined by the plan, ending in 2024.

iv. The HCE threshold is based on prior year compensation, which can either be the preceding Plan Year or Calendar Year (“lookback year”), as elected by the plan. If the Plan Year is used, the dollar threshold is the threshold for the Calendar Year in which the Plan Year for which the compensation is measured begins. If a Non-Calendar Year plan has made a calendar year election, the lookback year is the Calendar Year beginning in the prior Plan Year.

v. The compensation used for determining whether an officer is a Key Employee is determined using the Calendar Year dollar amount in which the Plan Year begins.

vi. These limits do not apply to grandfathered or retiree-only plans.

vii. These amounts are indexed to increase based on the average per capita premium for U.S. health insurance coverage from the prior Calendar Year. The Out-of-Pocket maximum limit for self-only coverage applies to all individuals (regardless of whether the individual is in self-only or another level of coverage). For example, a family plan with an $18,900 family Out-of-Pocket limit cannot have cost sharing exceeding $9,450 for an individual enrollee in the plan.

viii. These fees apply on a Plan Year basis and are indexed for CPI-U.

ix. These fees apply on a Calendar Year basis and are assessed monthly at 1/12 of the annual amount.

x. In addition, the Patient Protection and Affordable Care Act imposes a fee to help fund the Patient Centered Outcomes Research Institute (PCORI). The PCORI fee for Plan Years ending on or after Oct. 1, 2022, and before Oct. 1, 2023, is $3.00 per person covered by the plan. The fee for Plan Years ending prior to Oct. 1, 2022, was $2.79 per person. The PCORI fee is effective for Plan Years ending before Oct. 1, 2029.

xi. The health FSA carryover maximum is indexed at 20% of the health FSA salary reduction cap.

Article courtesy of Warner Norcross + Judd

Click here for more News & Resources.