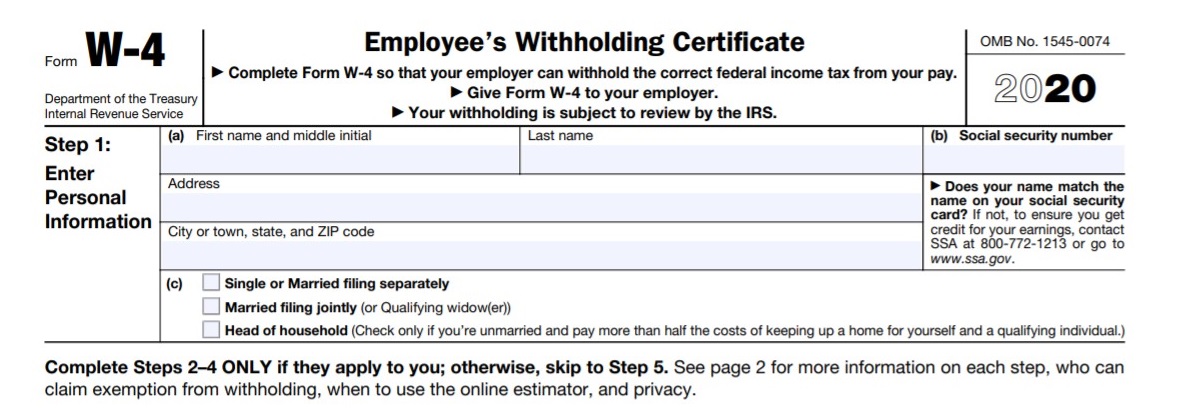

On Dec. 5, the IRS released the long-awaited final version of the 2020 Form W-4, retitled Employee’s Withholding Certificate, with major revisions designed to make accurate income-tax withholding easier for employees starting next year. In August, the IRS posted FAQs about the changes incorporated in the revised form.

These are the key points employers should note, the IRS said when the final version of the 2020 Form W-4 was released:

-

All new employees hired as of Jan. 1, 2020, must complete the new form.

-

Current employees are not required to complete a new form but can choose to adjust their withholding based on the new form.

-

Any adjustments made after Jan. 1, 2020, must be made using the new form.

-

Employers can still compute withholding based on information from employees’ most recently submitted Form W-4 if employees choose not to adjust their withholding using the revised form.

-

A new Publication 15-T, Federal Income Tax Withholding Methods, to be released in mid-December (it will be online here) for use with the new 2020 Form W-4, will include steps employers can take to determine federal withholding. The IRS posted an early release draft on Nov. 4.

The IRS updated the W-4 form to reflect tax code changes ushered in by the Tax Cuts and Jobs Act, which took effect last year. Unlike the 2019 Form W-4, the revised form excludes withholding allowances, which were tied to the personal exemption amount—$4,050 for 2017—and are now suspended (hence the form’s name change from Employee’s Withholding Allowance Certificate). It also replaces complicated worksheets with more straightforward questions.

“The primary goals of the new design are to provide simplicity, accuracy and privacy for employees while minimizing burden for employers and payroll processors,” IRS Commissioner Charles Rettig said. Changes made since the last draft include minor edits and added language on page 2 under “Your Privacy.”

“Employers can ask employees hired before 2020 to use the new form, but [employees] are not required to do so,” said Jon Barber, senior vice president of tax policy and research at Ayco, a financial counseling and investment management firm. Employers should, however, “explain that withholding will continue based on the form they previously submitted and may not be as accurate as using the new W-4.”

Alice Jacobsohn, senior manager of government relations for the American Payroll Association (APA), a payroll industry trade group, noted that:

-

If a newly hired employee in 2020 does not complete a 2020 Form W-4, the employer instructions state that employers should treat them as a single filer with no other adjustments.

-

If an employee only completes step 1 and 5, the employer is instructed to withhold based on the identified withholding status with no other adjustments.

As before, employees’ tax liability is based on combined income from all sources, including second jobs, investment income and a spouse’s earnings. “Additional tax may be due at the time of filing if withholding is not sufficient to meet tax obligations,” Barber explained. So employees may want to make adjustments to reflect these additional incomes, deductions and credits.

[SHRM members-only HR Q&A: Are employers required to have employees complete a new W‑4 each year?]

What’s Changed

The 2020 Form W-4 is presented on a single, full page, followed by instructions, worksheets and tables. In place of withholding allowances, the new W-4 includes a process with five possible steps for declaring additional income, so employees can adjust their withholding with varying levels of accuracy, privacy and ease of use.

The five steps are:

Step 1. Enter personal information.

Step 2. Indicate multiple jobs or if spouse works.

Step 3. Claim dependents.

Step 4. Make other adjustments including for:

Step 4(a): Investment and retirement income.

Step 4(b): Deductions other than the standard deduction.

Step 4(c): Any extra tax withholding per pay period.

Step 5. Sign the form.

The IRS explained that:

-

The only two steps required for all employees are Step 1, where they enter personal information such as their name and filing status, and Step 5, where they sign the form.

-

If Steps 2, 3 or 4 apply to employees and they choose to provide that information, their withholding will more accurately match their tax liability if they complete them. Employees, however, can adjust their withholding in Step 4(c) without sharing additional information.

“If an employee uses the IRS Tax Estimator or the Multiple Jobs Worksheet to calculate income from another job, the amount is placed in step 4(c),” Jacobsohn said. “Employees who just want additional withholding should also use 4(c).”

The space below step 4(c) is used for employees to identify that they are nonresident aliens or are exempt from paying taxes. “If you use an electronic form, developers are instructed to provide a place to enter the information, such as a check box,” Jacobsohn said.

An important consideration for HR and payroll departments, said Jamal Ayyad, a small business tax advocate at online payroll firm SurePayroll, is that “they may want to let new employees take the form home rather than complete it on their first day as is customary, because tax information is required that the employee might not have readily available.”

‘HR may want to let new employees take the form home rather than complete it on their first day.’

Easier for Employees

“Generally, the new Form W-4 is an improvement for employees,” said Pete Isberg, vice president of government relations at payroll and HR services firm ADP. “For example, previously, employees would complete a difficult worksheet to convert expected deductions to a number of withholding allowances. With the new form, they’ll just enter their full-year expected deductions over the standard deduction amount.”

Not requiring employees to submit the new W-4 will ease HR’s burden, but it also means that “employers will need to program their payroll system to accommodate the existing withholding calculation, as well as the new method,” Barber said. However, “companies’ payroll software will not necessarily require two different systems for the two different forms, since the same set of withholding tables will be used for both,” he explained.

Addressing Privacy Concerns

With the new version of the form, taxpayers can “indicate their desire to have more tax withheld without having to share details with their employer,” said Mike Trabold, director of compliance at Paychex, an HR technology services and payroll firm. Although this may lead to too much withholding for some taxpayers, “it will help address concerns of those who prefer to get a refund check every year or who may have had to unexpectedly pay tax when filing this year.”

A worksheet to help taxpayers with the new form “will not be provided to the employer, further assuring privacy,” Trabold noted.

Spread the Word

The About Form W-4 page on www.irs.gov has additional information about the revised form. In addition, the APA drafted a sample letter outlining key changes to Form W-4, with basic information about the new steps employees will take to complete the form.

“Employers can freely customize and share this letter with employees,” the APA said. The letter also recommends that employees perform a “paycheck checkup” using the IRS’s Tax Withholding Estimator (see below).

|

An Updated IRS Tax Estimator Employees can use the IRS Tax Withholding Estimator to help them complete the new Form W‑4. The calculator, updated in August with several new functions, is designed to help employees estimate any additional withholding. By using this tool, which the IRS says is mobile-friendly and uses plain language, employees “can more easily account for higher marginal tax brackets where both spouses work, additional income, and credits and deductions, and predict a tax refund or amount owed, as well as align their withholding as closely as possible to their actual tax obligation,” Barber noted. It’s especially important to use the estimator, the IRS advised, if an employee:

Said the American Payroll Association’s Alice Jacobsohn, “For employees starting a new job in 2020 or whose tax situation has changed, using the IRS’s Tax Withholding Estimator is a smart way to figure out their taxes and complete the form.”

|

Courtesy of SHRM, the foremost expert, convener and thought leader on issues impacting today’s evolving workplaces.